richmond property tax rate 2021

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Falls Church city collects the highest property tax in Virginia.

. 2 1000 of assmt value between 3M to 4M 0002 Tier 2. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. The City Assessor determines the FMV of over 70000 real property parcels each year.

Residential Property Tax Rate for Richmond Hill from 2018 to 2021. Counties and Richmond as well as thousands of. Taxes are based on the assessed value of land and buildings.

Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX. Understanding Your Tax Bill.

The city has elected to freeze the pptra rate at. Manage Your Tax Account. Property Taxes AND Flat Rate Annual Utilities Ten 10 monthly pre-payments August 1 to May 1 are automatically deducted from your bank account on the first of each.

Tax Rate 2062 - 100 assessment. Richmond Hill - 27 per cent of property taxes. Paying Your Property Taxes.

Richmond Hill accounts for only about a quarter of your tax bill. In this largely budgetary. You can use the Virginia property tax map to the left to compare Richmond Citys property tax to other counties in Virginia.

Ad Find County Online Property Taxes Info From 2022. Richmond residents will have until july 4 to pay their property taxes without penalty. 2022 Tax Rates.

What is the current tax rate. Assessment Methodology Business. These agencies provide their required tax rates and the City collects the taxes on their behalf.

Province of BCs Tax Deferment. Richmond residents will have until july 4 to pay their property taxes without penalty. Region of York - 50 per cent of.

There are three main steps in taxing real estate ie formulating mill rates appraising property market values and collecting payments. Due Dates and Penalties for Property Tax. Year Municipal Rate Educational Rate Final Tax Rate.

City Of Richmond Property Tax 2021. Real Property residential and commercial and Personal Property. The city has elected to freeze the pptra rate at.

City Of Richmond Property Tax 2021. Get Assessment Information From 2022 About Any County Property. The residential tax bill is divided as follows.

For information and inquiries regarding amounts levied by other taxing authorities. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. As computed a composite tax rate times the market value total will produce the countys total tax burden and include individual taxpayers share.

The tax rate is set annually around September 1st based on the assessment as of April 1st of that year and tax bills are sent to the.

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Www 2022 Notice Of Property Tax Increase

Alameda County Ca Property Tax Calculator Smartasset

Why Are Property Taxes So High In Texas Here Are 3 Reasons

Paying Your Property Tax City Of Terrace

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Why Are Texas Property Taxes So High Home Tax Solutions

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Vermont Property Tax Rates Nancy Jenkins Real Estate

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

28 Key Pros Cons Of Property Taxes E C

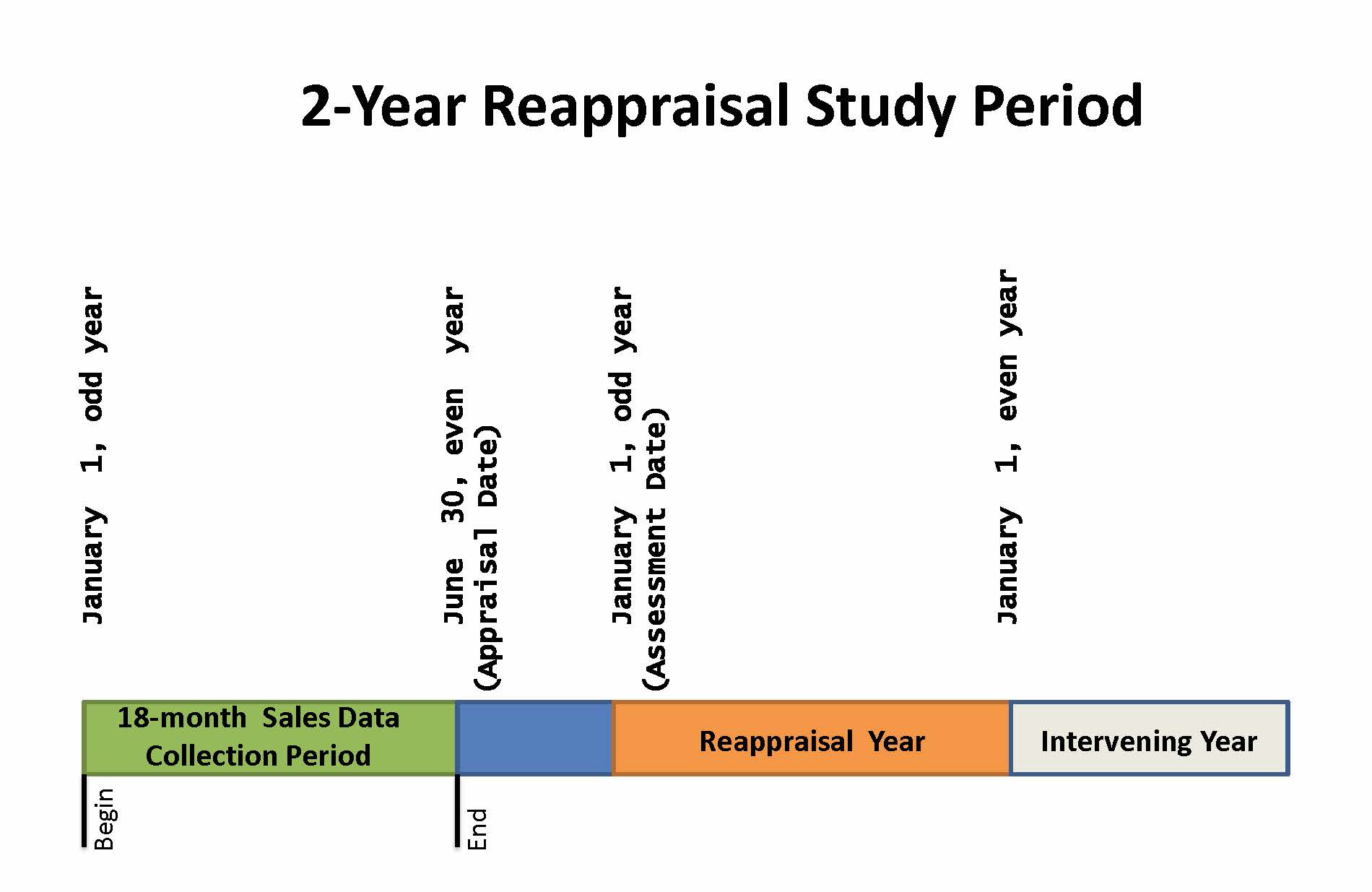

Property Assessment Process Adams County Government

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation